Since the article about donations for local campaigns last month, wealthy garbage collector Waste Connections has contributed $5,000 to the Political Action Committee (PAC) “Save Vancouver Parks.” It is the largest contribution of $18,645 raised thus far. The PAC is promoting the formation of a new Metropolitan Parks Tax District in the city of Vancouver by way of proposition M-3777 that placed the City of Vancouver Proposition No. 1 on this November’s ballot.*

A new parks tax district would give levy and taxing power to the Vancouver City Council, for now. Not explained to voters is the fact that the taxing authority can be reconstituted to an unaccountable appointed board in the future that would mean taxation without representation. Here is how it is stated in the voter’s pamphlet:

The Vancouver City Council passed Resolution No. M-3777 to allow voters to decide

whether to create the “Vancouver Metropolitan Park District,” to be governed by the

Vancouver City Council as the ex-officio board of park commissioners. If created, the

metropolitan park district would have all the powers under Chapter 35.61 RCW,

including the authority to levy a general tax on property not to exceed the statutory

maximum to support parks and recreation services. Shall the Vancouver Metropolitan

Park District be so created and governed?”

If approved, the Metro Park Tax District would have substantial powers of taxation. For example, although the starting rate in the ballot summary is $.35 per $1000 of property value, if approved, the new taxing authority could levy up to $.75 per $1000 of assessed value without any further vote, ($225/year for $300,000 property, homes, businesses, etc). The new Metro Parks Taxing authority would also be empowered to increase taxes due to borrowing via a bond for a park purpose, without any citizen vote. Other broad powers include eminent domain to obtain property whether the owner wants to sell or not. For more information, see truthbetoldclarkco.com.

When Clark County asked voters back in 2005 to form a new county Metropolitan Parks Tax District, Waste Connections contributed $2,000 to the cause. That vote was held in a February “special election,” when Clark County Commissioners Marc Boldt, Steve Stuart, and former Commissioner Betty Sue Morris were in office. The 2005 special-election county Parks Tax District formation was narrowly passed by only 27 votes.

In “Special Elections” the elections office does not prepare a voter’s pamphlet with statements “For” or “Against” ballot measures. This stifles public debate. For primary and November general elections voter pamphlets are mailed and available online. This year, some voter’s pamphlets may arrive after ballots, and it is worth waiting for. Getting informed and voting the full ballot is a citizen’s right, and duty.

C-Tran Seeks Tax Authority for Light Rail and Bus Rapid Transit

The 2012 C-Tran Proposition 1 asks voters to increase the sales tax to extend Portland’s Tri-Met light rail into Vancouver and add BRT 60 foot articulated buses for West Vancouver. If granted this taxing authority by a vote, C-Tran plans to extend these systems. Public Disclosure Commission (PDC) records show that last year, Waste Connections contributed a whopping $5,000 to the Keep Clark County Moving PAC for the C-Tran sales tax hike of 2011. That tax increase is estimated to raise about $9 Million per year to start. Along with generous donations from unions, bus manufacturers, Columbia River Crossing contractors and others, the PAC raised $110,566 and spent $102,280, including research, consultants, and mailers from companies based in Seattle and Massachusetts, signs, and a last minute robo-call featuring Clark County Commissioner and C-Tran Board member Marc Boldt. PAC funds are available for the 2012 election as well.

Clark County Commissioner and C-Tran board member Steve Stuart has recused himself from some votes on the C-Tran board because his wife, Heather Stuart, is paid to work for the Keep Clark County Moving PAC as shown in PDC Committee Expenditure report. Citizen groups are hard pressed to raise funds to counter. Two websites opposing the C-Tran sales tax hike for light rail/BRT have been posted, Prop1NO.com and Prop1Facts.com.

In addition, the C-Tran agency distributes fact pieces supportive of the ballot measure through three area newspapers and agency spokespersons present the ballot measure favorably at public meetings, all at taxpayer expense. The Columbian newspaper has promoted C-Tran sales tax hikes and light rail since at least 1996 when voters countywide voted on light rail and soundly rejected the plan. Since then, the boundaries for C-Tran voting have been gerrymandered down.

Other Waste Connections Donations and Public Agency Lobbying

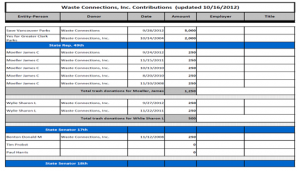

Waste Connections also recently contributed $250 each to democrat candidates for state representatives in the 49th district, Jim Moeller and Sharon Wylie and $900 more to democrat candidate for Clark County commissioner, Joe Tanner. Wylie was a lobbyist for Clark County and also for C-Tran prior to being appointed as State Representative by Clark County Commissioners in April, 2011. PDC data on these donations and Clark County and C-Tran lobbying expenditures have been added to the chart from the previous article on Waste Connections to local candidates. (PDF of chart below.)

Waste Connections also contributes to the WA Refuse and Recycling PAC, who in turn contributes to state legislative campaigns. Overall, PDC records indicate that Waste Connections and their wealthy executives have favored democrats and tax increase ballot measures in SW Washington. Raising taxes helps insure local governments can spend more on solid waste and recycling contracts in the future.

Public agency lobbying is difficult to track. Public agencies that contract with a lobbyist are to file a quarterly Public Agency Lobbying Report C5, and lobbyists also file reports. An agency who has staff who lobby is required to file the report only if the agency lobbies in person more than 4 days per quarter or spends more than $25 out-of-pocket to entertain. Furthermore, the PDC website notes, “Public Agency Lobbying reports are not required to be filed electronically. This report does NOT include paper-filed Public Agency Lobbying reports or their data.” No PDC reports are available on what the taxpayer-funded lobbying is for, but in general, the lobbying is for more tax dollars.

The PDC website informs citizens on the individuals or companies with the biggest financial influence over elected officials. By comparing the contributors to Keep Clark County Moving PAC and local candidates voters can learn who is supporting the CRC light rail extension from Portland into Vancouver. Anomalies can also be uncovered, such as the failure of some candidates to list the details on all contributions that are over $100, as they are required to.

One oddity is that Rep. Moeller consistently spends $500 for “vehicle expense” or “car allowance” monthly from campaign funds, even when the legislature is in session and it is not an election year. His campaign manager is also paid monthly throughout every year, now at a rate of about $2500/month plus bonuses.

Click on the chart below to view WCI donations, public agency lobbying expenditures, and other contributions as reported by the Public Disclosure Commission, as of 10-16-12.

* Ballots and voter pamphles are being mailed to voters this week. Voters can cast ballots up to and including Election Day, Tuesday Nov. 6. On Election Day, voters can hand deliver their ballots to drop off locations. Mailed ballots can be lost or postmarked after Election Day, disqualifying them. Also, updated campaign contributions or news is a good reason to wait to cast a ballot on Election Day, in person.

Related COUV.COM articles:

Waste Connections Inc. lobby for local campaigns

Another C-Tran sales tax hike proposition

Behind the scenes of Washington State’s voter ballots